On 28 July 2023, a new bill of law (reference 8286) reshaping the Luxembourg accounting law has been published (the Bill). Main driver of the Bill is to cover all accounting obligations in a single accounting law and broaden its scope of application by including additional types of undertakings.

The Bill transposes principles and obligations from the Directive 2013/34/EU on annual financial statements, consolidated financial statements and related reports, into a single law, notably by including micro undertakings, additional requirements for large holding companies and implementing some non-financial reporting on sustainability for specific undertakings.

I. Modernisation, restructuration and extension of the scope of application of a ‘single accounting law’

-

Accounting provisions consolidated within a ‘single accounting law’

The Bill aims to modernise applicable accounting law by remedying the wide dispersion of accounting provisions.

-

Extension of the scope of application

The Bill extends the scope of application of the accounting law to non-commercial undertakings (civil companies, agriculture associations, mutual assurance associations, pension-savings associations, fonds commun de placement, sociétés commerciales momentanées and sociétés commercialese en participation). The société en commandite speciale- S.C.S.p.s will now have filing requirements.

In addition, the Bill aims to modernise the accounting regime applicable to dissolved and liquidated entities by implementing yearly filing requirements as well as per the completion of the liquidation.

-

Introduction of the ‘bottom-up’ and list-based approaches

As opposed to previous legislation, a bottom-up approach will be implemented. The small enterprises regime forms the common base applicable to all entities. For medium-size and large companies, additional obligations are required. Moreover, the Bill proposes to implement exhaustive lists enumerating forms and categories of the covered entities, while excluding micro-undertakings (‘micro-entreprises’) from these approaches.

II. New obligations

-

Introduction of the ‘micro-enterprises’ concept and new threholds for small-sized entities

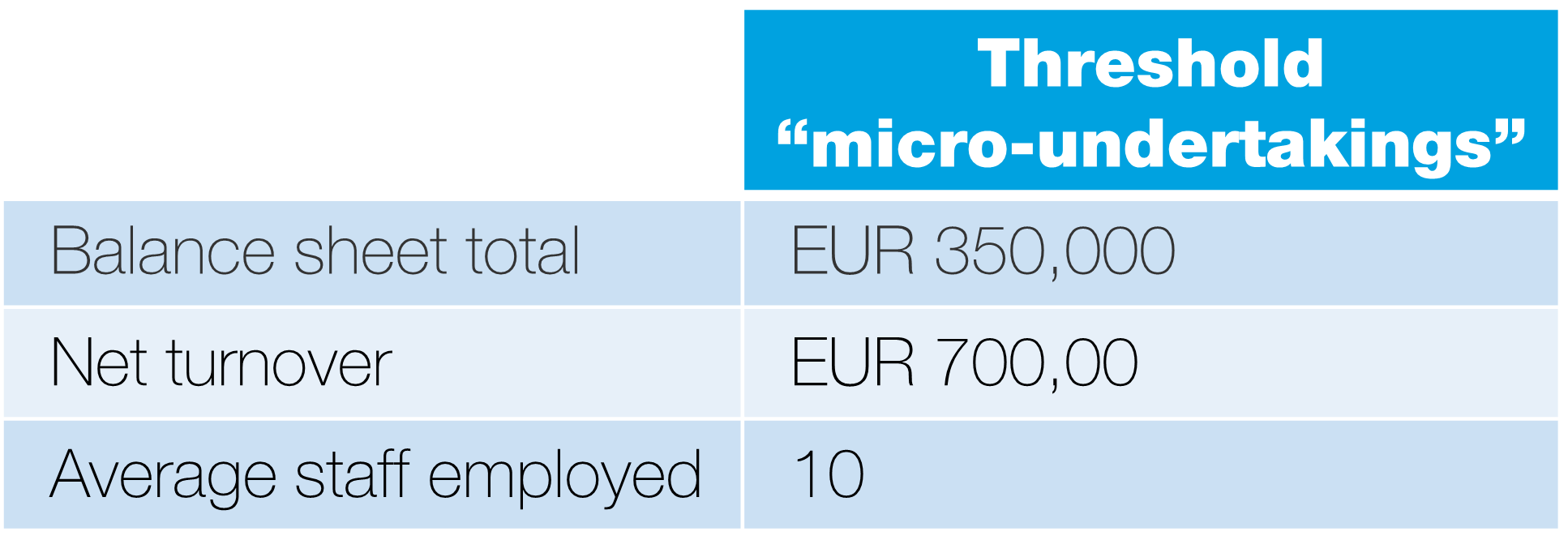

The Bill also introduces an optional regime for micro-undertakings allowing companies which do not exceed the amount fixed for two of the three following criteria for two consecutive financial years to benefit from simplified measures for accounting purposes (mainly the exemption of notes to the annual accounts). Among others, holding entities, credit institutions, insurance companies, and securitization vehicles are excluded from this option.

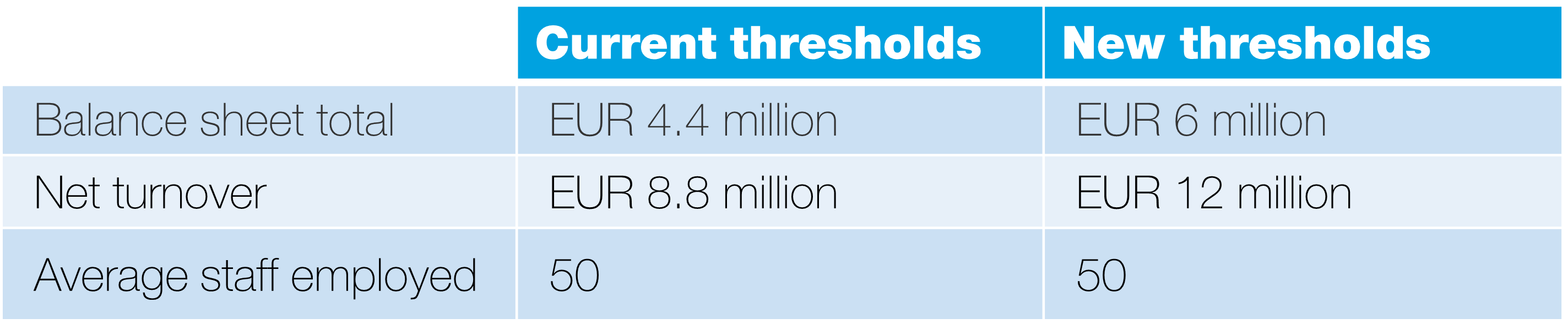

As some treshholds will be raised, businesses previously subject to full accounting obligations may now fall within the scope of the small-sized entities regime and benefit from a reduction of their administrative burden.

-

Large holding companies’s new obligation

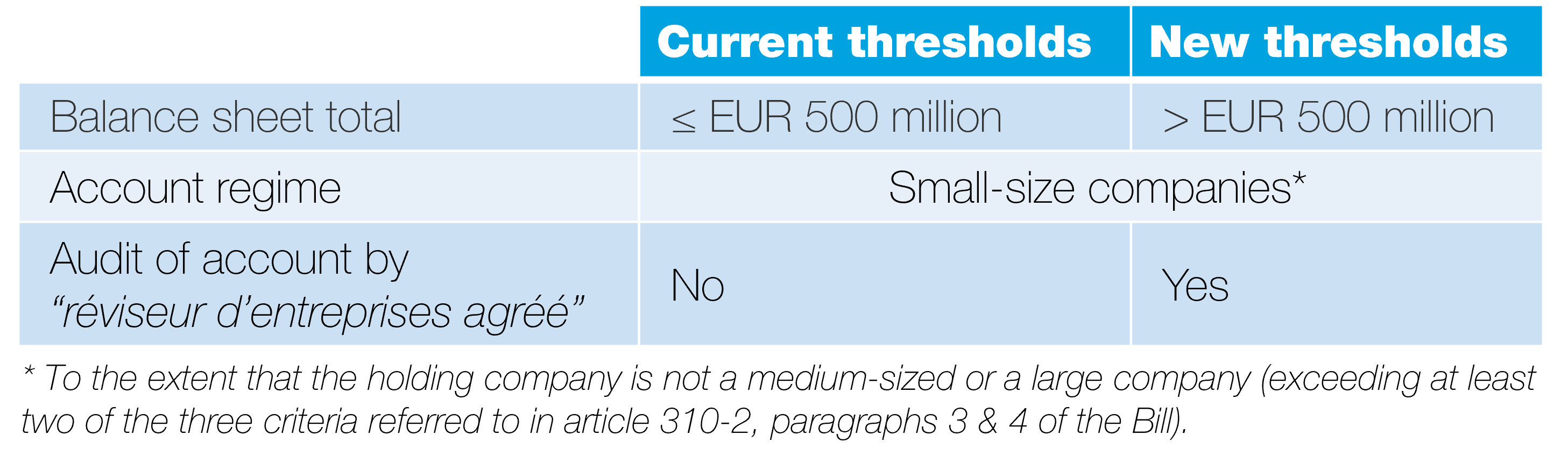

The Bill introduces the concept of large holding companies, which will have to comply with some new audit obligations depending on their balance sheet total:

-

Non-Financial reporting obligations

Public-interest entities having more than 500 employees (financial year 2024) must include in the management report information addressing the undertaking’s impact on sustainability matters, as well as information necessary to understand how sustainability matters affect the undertaking’s development, performance and position. Additionally, a description of the diversity policy applied in relation to the undertaking’s administrative, management and supervisory bodies should be included in the corporate governance statement.

If an undertaking has no sustainability policy or diversity policy, reports on why it is not the case should be included in the non-financial report and the corporate governance statement.

The members of the administrative, management and supervisory bodies are collectively responsible for complying with the obligations relating to the issuance of the non-financial report.

III. Other changes

The Bill abolishes the function of ‘commissaire aux comptes’.

Final remarks

The Bill introduces obligations for various Luxembourg businesses, and as some of them will apply as from the financial year 2024, businesses should start checking what these changes would imply for them.

Should you have any question, please reach out to an author of this flash or to your trusted Loyens & Loeff contact.