Introduction

The Corporate Sustainability Reporting Directive (CSRD) is a European directive that requires companies within its scope to generate a sustainability report and that mandates an audit of this report. This sustainability report must contain information necessary to understand the impact of their business on sustainability matters, and how sustainability matters affect the development, performance and position of their business. This information must be published by means of said report on which a (limited) assurance must be provided by external party. The primary goal of the CSRD is to guarantee that companies and investors are provided with consistent and trustworthy sustainability information. This objective is pursued through the enforcement of a framework of regulations specifically crafted to harmonize sustainability reporting with established financial reporting standards.

The CSRD entered into force on 5 January 2023, but being a European directive it needs to be implemented by the EU Member States. This article offers insights into the progress of implementing the CSRD in the Netherlands and highlights our key takeaways.

More publications on the CSRD, and other sustainability legislation, can be found on our dedicated ESG webpage.

Dutch implementation process

To facilitate the integration of the CSRD into the Dutch legal system, the Dutch legislator has proposed the following implementation instruments:

- On 1 July 2022, the Dutch government published a Bill implementing directive (EU) 2021/2101 on disclosure of income tax information, which also introduces a new provision (Section 2:391a of the Dutch Civil Code (DCC). This provision provides a basis for establishing rules by governmental decree (Algemene Maatregel van Bestuur) to implement binding EU legal acts covering certain undertakings' obligations to include information in the management report. The Bill has been adopted by the Dutch House of Parliament, however adoption by the Dutch Senate is pending. The directive must be implemented into national legislation by 22 June 2024.

- On 17 July 2023, the Dutch government published a draft implementing Bill covering the rules on assurance of CSRD reports and the applicability of the CSRD to listed companies and other public interest companies as per the matrix set out below. The public consultation period ended on 10 September 2023, following which the Dutch legislator is expected to prepare a formal draft Bill which will then have to be submitted to the Dutch House of Parliament and the Dutch Senate.

- On 20 November 2023, the Dutch government published a public consultation regarding the Implementation Decree for the Corporate Sustainability Reporting Directive (Implementatiebesluit richtlijn duurzaamheidsrapportering) (Draft Decree). The Draft Decree includes the sustainability reporting requirements for the companies in scope which are to be drawn up in accordance with the European sustainability reporting standards (ESRS) developed by the European Commission, rules on the assurance statement and the audit committee, and implementation timelines. The consultation period for this Draft Decree expires on 18 December 2023, during which it is possible to submit feedback to the Ministry of Justice.

Our key takeaways

In formulating the Draft Decree, the Dutch legislator has refrained from imposing stricter, additional provisions beyond the requisites outlined by the CSRD.

The sustainability reporting obligations are proposed to be embedded in the provisions of, and pursuant to, Title 9 of Book 2 of the Dutch Civil Code (Title 9) concerning the annual accounts and the board report. Therefore, there is a fundamental alignment with the concepts outlined in Title 9. This includes the size criteria for classifying an undertaking in four different categories (micro, small, medium-sized and large) as well as the provision that an undertaking is only eligible for a particular category if it meets at least two out of three criteria for that category on two consecutive balance sheet dates (without interruption).

Nevertheless, the Draft Decree does provide for certain specific corporate law definitions which are relevant to determine the scope of sustainability reporting obligations. These include:

- company’ (vennootschap): vennootschap has been selected as a collective term for purposes of the Draft Decree and comprises (i) a Dutch public limited liability company (naamloze vennootschap or V.), (ii) a Dutch private company with limited liability (besloten vennootschap met beperkte aansprakelijkheid or B.V.) and (iii) a general partnership (vennootschap onder firma or VoF) or a limited partnership (commanditaire vennootschap or C.V.)all partners of which, who are fully liable towards creditors, are capital companies under foreign law.

The wording of item (iii) aligns with how the Netherlands have implemented the Accounting Directive in respect of the financial reporting obligations. However, it does deviate from the Accounting Directive (and the CSRD) in that it does not capture limited or general partnerships all partners of which, who are fully liable towards creditors, are N.V.s or B.V.s, and thereby providing for a more narrow scope. In the draft Explanatory Memorandum (Nota van Toelichting), however, the wording is said to align with that of the Accounting Directive, which creates some confusion that we hope will be clarified as the Draft Decree is taken forward. - ‘large group’ (grote groep): ‘large group’ is an important concept under the CSRD but not yet defined in the DCC. The Draft Decree defines this term by applying the size criteria to the existing concept of ‘group’ of Section 2:24b DCC. In short, a group exists if the following three criteria (cumulatively) are met: (i) organisational affiliation, (ii) economic unity, and (iii) central management. Organisational affiliation refers to integration of the organisations within the group. Economic unity and central management are only present if actual (central) control is exercised (and thus not just the ‘ability’ to exercise such control). In other words, a group only exists if several undertakings act as an economic unit under joint management. A group is ‘large’ if it on a consolidated basis meets at least two out of three criteria for the ‘large’ category on two consecutive balance sheet dates (without interruption).

The Dutch legislator explicitly acknowledges that a company that benefits from an exemption from financial reporting obligations is not automatically (also) exempted from sustainability reporting obligations, thereby citing Recital (26) of the CSRD. For example, a company that benefits from the intermediate holding exemption under the financial reporting obligations may not necessarily benefit from the equivalent exemption under the sustainability reporting obligations. This is particularly relevant for intermediate holding companies with (ultimate) parents outside the EEA.

The CSRD allows Member States a limited number of options whereby they can choose to implement the CSRD in a certain manner. The Dutch legislator proposes to utilise some of these Member State options, including:

- Allow omission of commercially sensitive information: The Draft Decree allows in-scope companies, under exceptional circumstances, to omit commercially sensitive information from sustainability reporting if such disclosure would significantly damage the company's commercial position. The Dutch legislator has opted for this option to ensure a necessary balance between the public interest in sustainability reporting and the avoidance of substantial harm to the company's commercial position.

- Permitted languages: The Draft Decree requires an exempted subsidiary to publish the consolidated management report or the consolidated sustainability reporting of its parent company in either Dutch, German, English or French. This aligns with the language requirements specified in Section 2:394(1) DCC which recognises these languages for the purpose of drawing up a company’s financial statements.

- Internal supervision of sustainability (reporting) obligations: As a starting point, the audit committee of an in-scope entity will be responsible for the (internal) supervision of the company’s adherence to its sustainability (reporting) obligations. The Draft Decree, however, allows in-scope companies to allocate this responsibility to another ‘corporate body’(orgaan). The draft Explanatory Memorandum mentions a dedicated sustainability or corporate responsibility committee as examples of such other corporate body. Such committee, however, would in itself not be a corporate body but rather a committee of the supervisory board or, in a one-tier structure, the board of directors.

- Exemption for the Dutch Central Bank, public development banks and credit unions: The Dutch legislator intends to utilise the Member State option to exclude central banks (in the Netherlands, this is the Dutch Central Bank (De Nederlandsche Bank, DNB), public development banks, and credit unions from the CSRD, thereby citing, among other reasons, the non-commercial nature of these entities and the unique status of DNB as the central bank.

- No obligation for subsidiaries and branches of companies from third countries to disclose information on the net turnover that these third-country companies have generated on Dutch territory and within the European Union: The Dutch legislator has chosen not to exercise this option. Instead, in alignment with the Decree Implementing the Directive on the Disclosure of Corporate Income Tax (Besluit Implementatie Richtlijn Openbaarmaking Winstbelasting), the legislator proposes to opt for a requirement for the auditor to ascertain whether the subsidiary falls under the obligation of this Decree to publish a sustainability report. This places a potential obligation on the auditor.

- Assurance by others than the statutory auditor still under consideration: The CSRD allows Member States to authorise an audit firm or other assurance provider, other than the audit firm conducting the statutory audit of financial statements, to perform the assurance examination on a company’s sustainability reporting. This option is currently under consideration by the Dutch legislator.

Timing of application of the CSRD

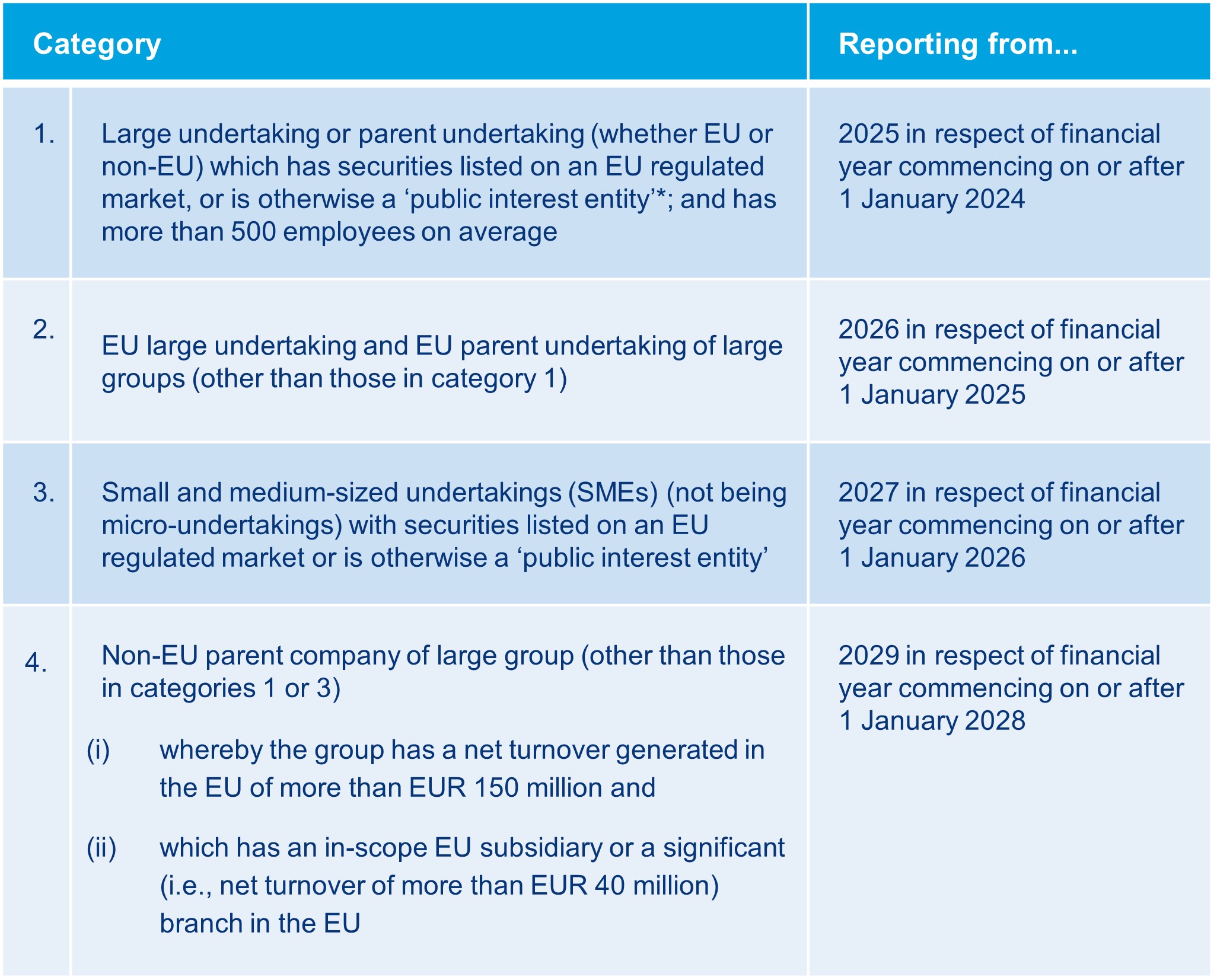

The CSRD must be implemented into national legislation by 6 July 2024, since in 2025 the first group of companies is required to publish their sustainability reports in respect of the financial year of 2024. As per the CSRD, the Draft Decree caters for a phasing in of the sustainability reporting requirements from 2024 to 2028 along for the following categories of companies:

*‘Public interest entity’ is defined under Article 2(1) of the Accounting Directive and includes EU undertakings having securities listed on a regulated market as well as certain other specific types of undertakings (such as credit institutions and insurance undertakings) and entities designated as such by the relevant Member State.

As regards the size criteria, please also see our previous publication.