For more information on Pillar One we refer to our tax flashes of 13 October 2020, 2 July 2021 and 11 October 2021.

Background

For several years, the Inclusive Framework explored adapting the international tax rules to an increasingly digitalised economy. On 8 October 2021, almost all members of the OECD/G20 Inclusive Framework agreed on certain key parameters to reallocate some taxing rights to market jurisdictions (“Pillar One”) and to introduce a global minimum effective taxation (“Pillar Two”). The 8 October 2021 agreement applies not only to “digital” MNEs but to all MNEs, irrespective of their business.

Pillar Two

On 20 December 2021, the OECD released its Pillar Two model rules for participant jurisdictions to implement most of the Pillar Two rules. These rules seek enforcing a minimum 15% effective tax rate on profits earned by large multinational enterprises in each jurisdiction where they realise profits. The entry into force of most of these rules is targeted for 2023 (see our tax flash of 21 December 2021).

Pillar One

The Inclusive Framework has developed “Amount A” (deemed “residual profit”) of Pillar One as a new taxing right over a portion of the profits that large and highly profitable enterprises (“Covered Group”) realise in jurisdictions where they supply goods or services, or where consumers or users are located (hereafter, “market jurisdictions”). Until 2031, only groups that have a global turnover above EUR 20 billion and a pre-tax profit margin above 10% would be "Covered Groups”.

Implementing Amount A of Pillar One requires developing:

- A Multilateral Convention (“MLC”),

- Explanatory Statement to the MLC,

- Model Rules for domestic legislation (“Model Rules”) for implementing Amount A, and

- Commentary to the Model Rules.

On 4 February 2022, the OECD Secretariat released for consultation a working document illustrating the Model Rules for nexus and revenue sourcing (“Working Document”). Once there is a consensus at Inclusive Framework level, jurisdictions will still be free to adapt these Model Rules to reflect their own constitutional law, legal systems, and domestic considerations and practices (albeit within the European Union the European Commission plans to issue a directive to ensure a coordinated implementation of Pillar One rules).

What does the Working Document entail?

The Working Document provides the current draft Model Rules for two elements of Amount A: (1) the nexus rules and (2) the revenue sourcing rules.

Nexus rules

Jurisdictions will only obtain taxing rights on Amount A if the Covered Group realises revenue derived from third parties (other than revenue derived from regulated financial services and extractive industry sectors) in that jurisdiction during a period (normally a year) of at least:

- EUR 1 million for jurisdictions with an annual GDP of at least EUR 40 billion, or

- EUR 250,000 for jurisdictions with an annual GDP of less than EUR 40 billion.

Source rules

The Model Rules also contain rules concerning the allocation of revenue between the jurisdictions. The OECD’s Task Force on the Digital Economy intends to balance the need for accuracy with the need to limit compliance costs. The source rules accordingly use (1) available information to reliably identify the market jurisdiction based on a range of possible indicators, (2) an allocation key that is expected to provide a reasonable approximation to determine the market jurisdiction if no indicator is available, or (3) in very specific cases, a back-stop rule to ensure that no revenue shall be unsourced.

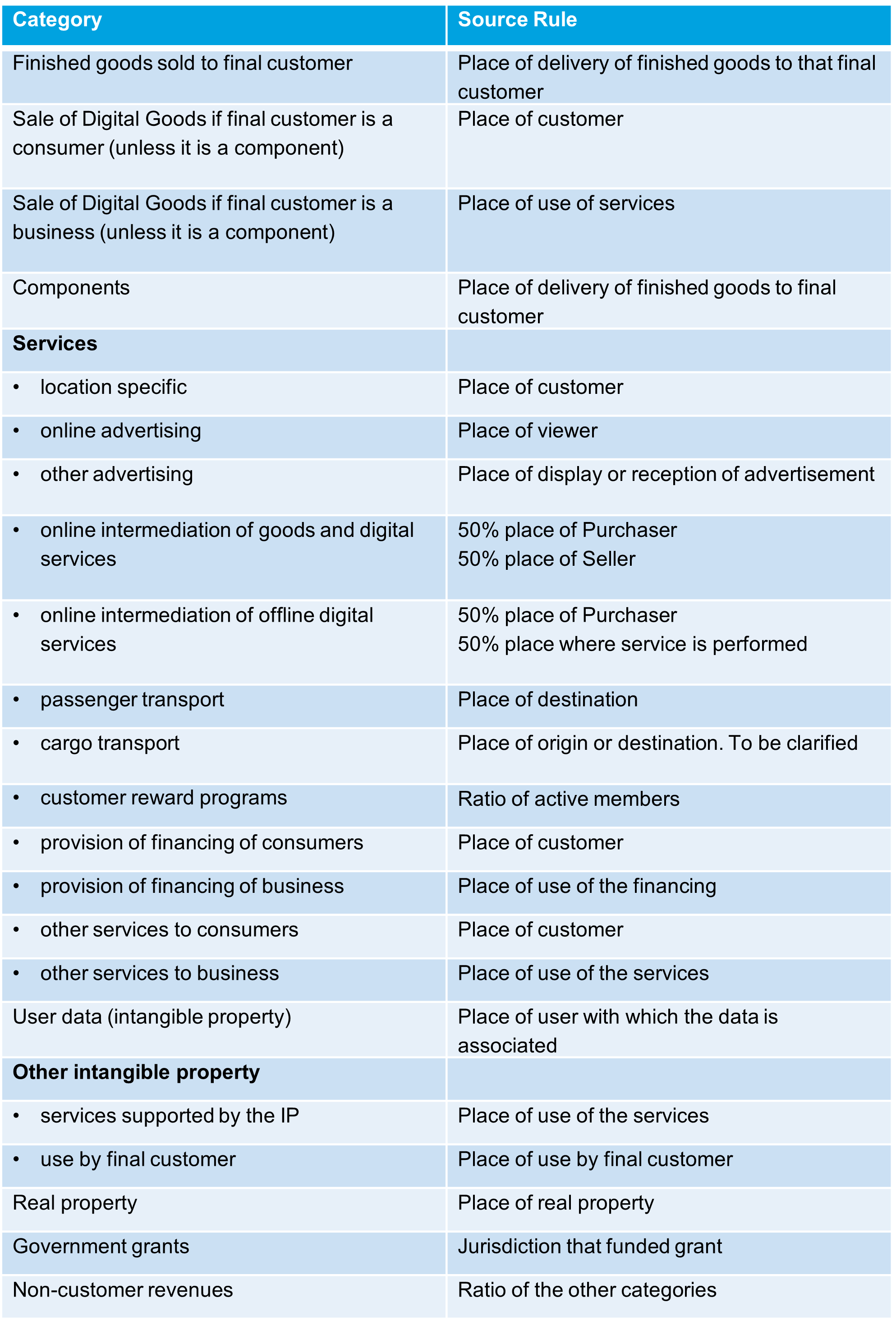

The Working Document also includes a schedule showing details per category of revenue (finished goods, components, services, intangible property, real property, government grants, and non-customer revenues), as well as some remarks that will be included in the Commentary to the Model Rules.

Revenues must be sourced according to the category of revenues earned from the transaction. A transaction comprising different elements that fall under more than one category will be sourced according to its predominant character. The categories are:

The source rules would also provide for detailed record-keeping requirements, based on a systemic approach rather than a requirement to retain and supply information on every transaction to tax administrations (focus on reliable methodology). This requires an internal control framework demonstrating a Covered Group’s conceptual approach to source rules including internal checks to monitor the accuracy of the system.

What are the next steps?

As to Amount A of the Pillar One rules, the OECD Secretariat intends issuing Working Documents in stages in the coming months on the separate building blocks. The OECD Secretariat indicated they still plan to develop the MLC “early 2022”. They also still strive to have sufficient ratifications in 2022, so that the reallocation of taxing rights on Amount A can occur as from 2023. The MLC would include a removal of and renouncement to digital service taxes and similar measures.

For Amount B of Pillar One (standardised arm’s length return for baseline marketing and distribution activities), a public consultation document will be issued mid-2022 with a public consultation event to follow the comment period. Technical work on Amount B will continue throughout 2022.

What can taxpayers do?

Implementing Pillar One by 2023 is very ambitious, but political pressure is strong.

Step 1: Determine whether your MNE is a Covered Group under the Pillar One rules.

Step 2: Determine which revenue sourcing rules apply to your business.

Step 3: Based on the details in Schedule A in the Working Document, attempt determining the jurisdictions that have qualifying allocated revenue for the allocation of Amount A.

Step 4: Based on the experience gained in step 3, determine whether your MNE wants to contribute to the public consultation (before February 18).

Step 5: Include the results of step 3 in a Pillar One impact assessment model.

Step 6: Since Pillar One might enter into force in 2023, the key lessons drawn from the modelling exercise should help MNE groups assess the need for restructuring to mitigate the tax compliance burden and increased taxation. This assessment will notably depend on the national tax reforms further to this global tax overhaul, the cost/benefit analysis of being present in certain jurisdictions, and the available mechanisms to mitigate the risk of double taxation.

We would be happy to assist you in preparing a reaction to the consultation or any other step indicated above. We will keep you informed about further developments. Should you have any question or need assistance in assessing the impact of the rules, please contact a member of our Digital Economy Taxation team or your trusted Loyens & Loeff adviser.