Corporate income tax

Decrease of the energy investment deduction percentage

As of 1 January 2024, the rate of the energy investment deduction (energie-investeringsaftrek or EIA) will be decreased from 45.5% to 40%. Furthermore, the sunset clause of the energy and environmental deductions has been extended to 2028 meaning they will in principle remain in force until then.

Energy tax

Abolishment of the input exemption for metallurgical and mineralogical processes

As of 1 January 2025, the energy tax exemption for electricity and/or gas used for metallurgical and mineralogical processes will be abolished. The Dutch government considers these exemptions to function as fossil subsidies, which should no longer be continued in view of current climate goals.

Introduction of a new specific input exemption for production of hydrogen

An energy tax exemption for the supply of electricity used for hydrogen production by electrolysis will be introduced as of 1 January 2025. This exemption is limited to electricity used directly in the process of converting water into hydrogen, such as the demineralization or electrolysis of water as well as the purification and compression of hydrogen produced from this water.

Changes to exemptions relating to electricity production

As of 1 January 2025, several changes are suggested to the system of exemptions for electricity production (including by means of cogeneration). In short, this concerns the following:

- The output exemption for the own use of electricity produced by cogeneration installations will be limited to installations with a maximum thermal capacity of 20 MW.

- The input exemption for gas used to generate electricity will no longer apply in general, but will continue to apply only for a pre-determined amount of natural gas in Nm3 per kWh of electricity produced.

- The input exemption for electricity used to generate electricity will be broadened to also include the use for maintaining production capacity.

Phase-out of the special energy tax rate for the greenhouse horticulture sector

A lowered energy tax rate for the greenhouse horticulture sector currently applies. This lowered rate will be gradually phased out as of 1 January 2025, until fully abolished in 2030.

Changes to energy tax brackets

A new lower bracket in the energy tax will be introduced for both electricity and gas as of 1 January 2024. This concerns the first 2.900 kWh of electricity and 1.000 m3 of gas. The measure is aimed at providing the government with a possibility to specifically lower the energy tax for households in the future and largely corresponds to the current price cap in place for households.

Amendments to the rules for block heating

Certain changes will be made in the tax rules for block heating, amongst others to take into account the changes in the tax brackets as describe above.

Carbon tax

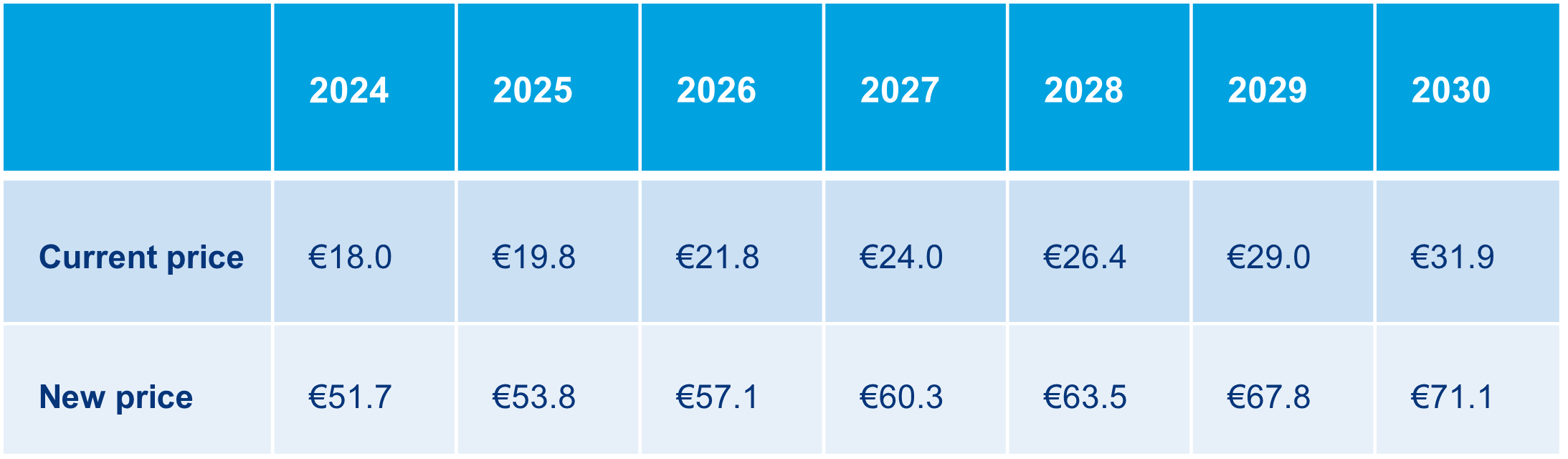

Increased minimum carbon tax price for the industrial and electricity generation sector

The Dutch minimum carbon tax prices for the industrial and electricity generation sector will increase as of 1 January 2024. However, considering the current EU ETS price, the Dutch government does not expect the increased minimum prices to lead to any budgetary effects. The new minimum prices are as follows:

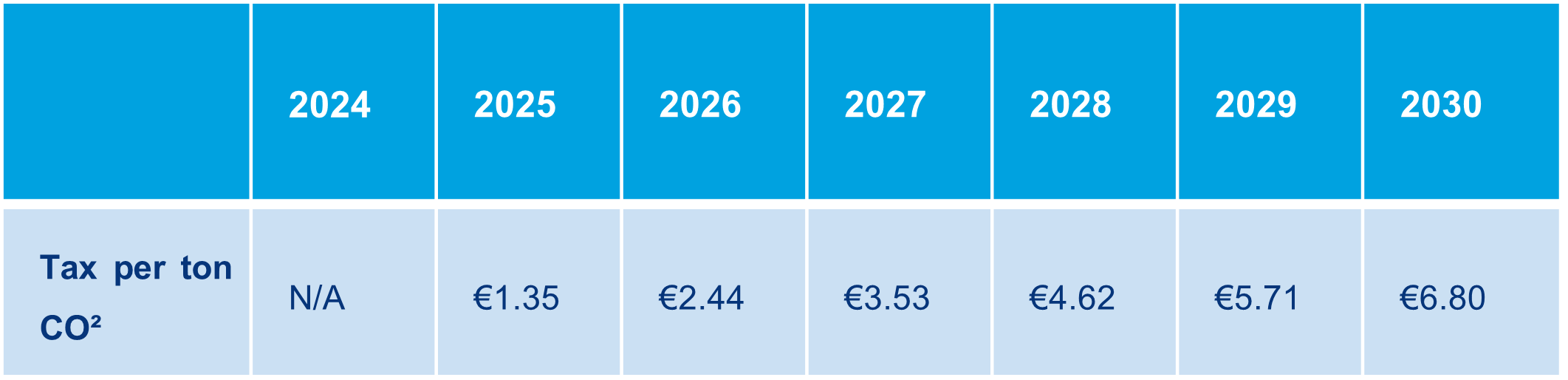

Introduction of a carbon tax for the greenhouse horticulture sector

As of 1 January 2025, a carbon tax will be introduced for CO2 emissions by the greenhouse horticulture sector, similar to the current system for the industry. This coincides with the introduction of certain EU ETS obligations for the built environment. The proposed carbon tax rates for this sector are as follows:

Coal tax

Abolishment of certain coal tax exemptions

As of 1 January 2028, the coal tax exemptions for (i) the dual use of coal and (ii) the non-energy use of coal will be abolished. The current coal tax rate is EUR 16,47 per metric ton.

Other

Introduction of Staid Aid information obligations

New information obligations will be incorporated in certain energy tax rules, following the European Commission’s guidelines on State Aid for climate, environmental protection and energy. As of 1 January 2024, these rules will therefore include certain principles on the basis of which data and information is provided (upon request) in order to comply with these EU obligations.