Tax deductibility company cars

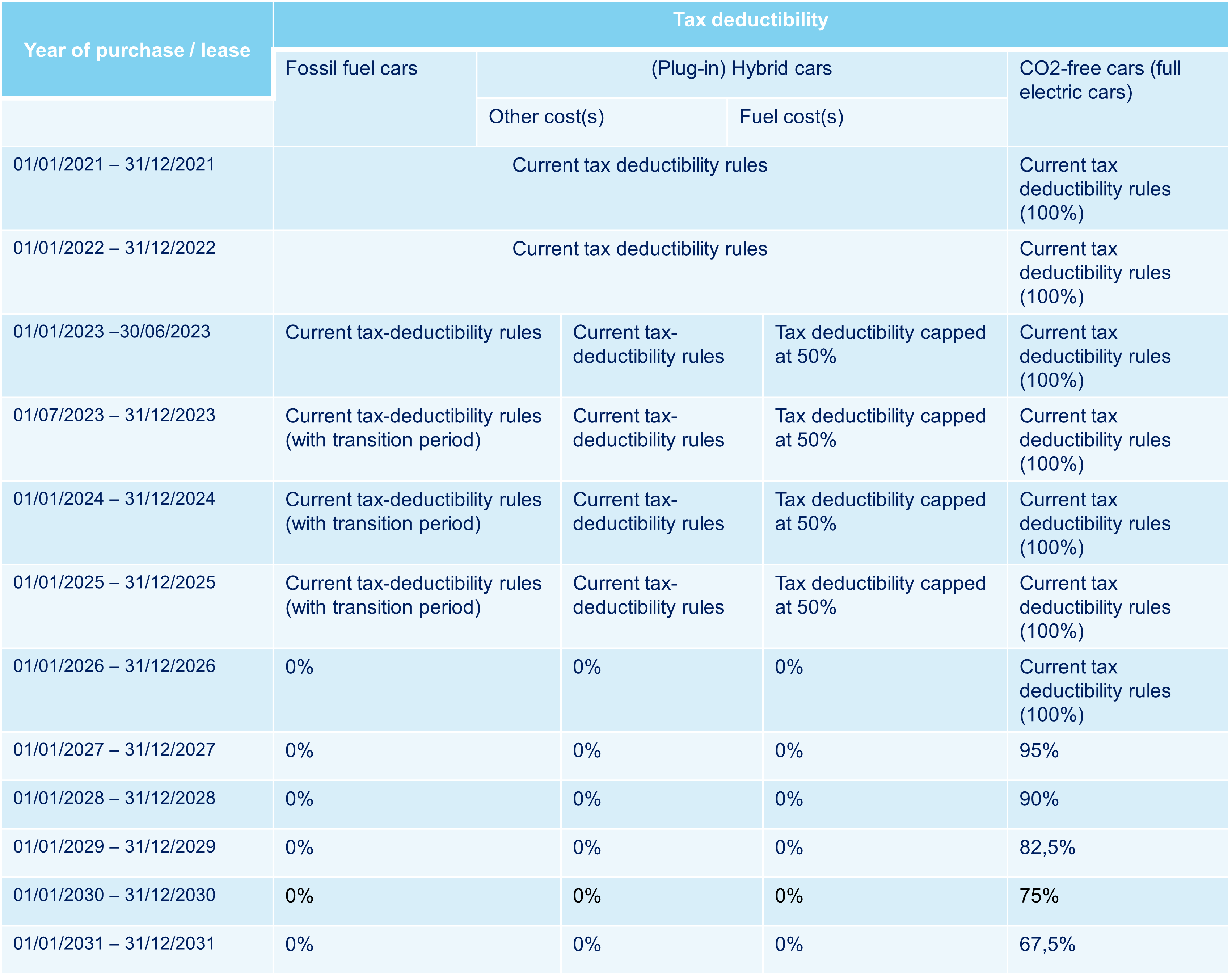

Below tables illustrate the intentions of the government on how to stream companies towards CO2-emission free cars (full electric cars) by capping the tax deductibility for companies of (even CO2-emission free) company cars in the future.

- A transition period exists for fossil fuel cars purchased / leased between 01/07/2023 and 31/12/2025: the tax deductibility will be capped at 75% in 2025, at 50% in 2026, at 25% in 2027 and 0% as of 2028. The tax deductibility of fossil fuel cars purchased / leased as of 01/01/2026 will be in any case 0%.

- Even though there is no reference made to “fake” hybrid cars, it can be expected that the current reasoning of assimilating fake hybrid cars with comparable fossil fuel cars shall continue to be applied as well.

Please note that:

- The above changes only apply with respect to new cars meaning that existing (lease) contracts shall not be impacted by these changes.

- The changes that government intend to apply for company cars does not affect (at this stage) the employee and his/her taxable benefit for having for free at his/her disposal a company car.

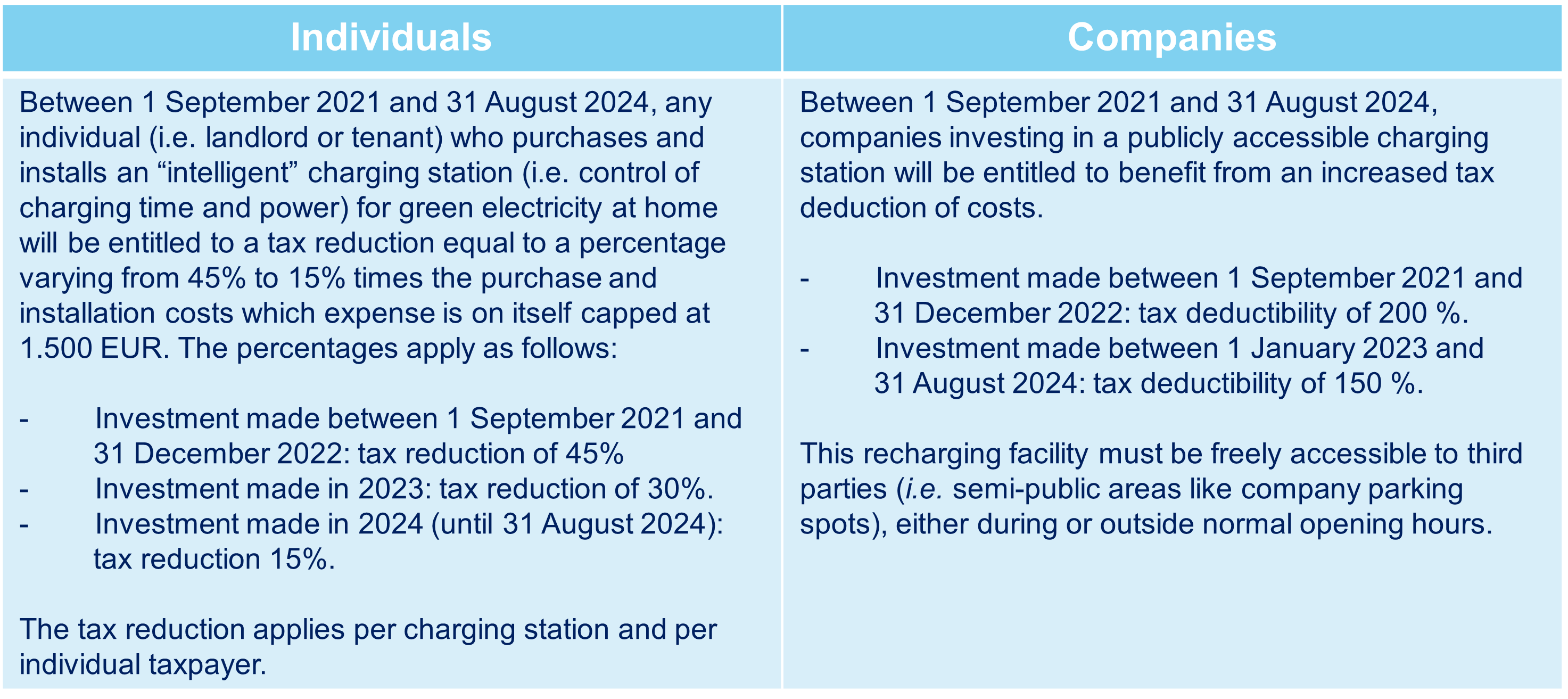

Charging stations at home and at the workplace

The government also aims to encourage an accelerated increase in the number of charging points for electric (and plug-in hybrid) cars, both at home and at the workplace. Hence, the following tax benefit has been developed:

Expanding the mobility budget

The mobility budget shall be simplified, made more flexible and further expanded to encourage a shift in greener mobility. The Finance Minister announced that the following elements will become part of the alternative/ softer mobility:

- Financing costs (g. loans for bicycles), parking costs and the costs of equipment that improves the safety and visibility of soft mobility.

- Electric mobility devices', such as electric steps, are also considered soft mobility.

- Public transport abonnements for the employee’s family members living in the same household.

- Parking fees related to the use of public transport.

- A premium for walking from the residency place to the workplace.

- Housing costs extended to a radius of 10 kilometers from the workplace (instead of currently 5 kilometers). Mortgage capital repayments will now also be taken into account.