By adopting Regulation (EU) 2019/1156 on facilitating cross-border distribution of collective investment undertakings (‘CBDF Regulation’) and Directive (EU) 2019/1160 on facilitating cross-border distribution of collective investment undertakings, the EU aims to create a level playing field for the cross border marketing and distribution of funds in the EEA, while at the same time ensuring more uniform and better protection for investors.

Following the CBDF Regulation, applicable as of 2 August 2021, AIFMs, EuVECA managers, EuSEF managers and UCITS management companies must ensure that all marketing communications addressed to investors are:

- identifiable as being marketing communications, and

- describe the risks and rewards of purchasing units or shares of an AIF/UCITS in an equally prominent manner, and

- contain information which is fair, clear and not misleading.

The ESMA guidelines on marketing communications under the Regulation on cross-border distribution of funds (‘ESMA Guidelines’) aim to further clarify the requirements that funds’ marketing communications must meet when directed at professional or retail investors.

Do not hesitate to contact the authors for more information about the marketing of funds in one of our home jurisdictions or regarding additional national requirements regarding marketing communications.

What is marketing communication?

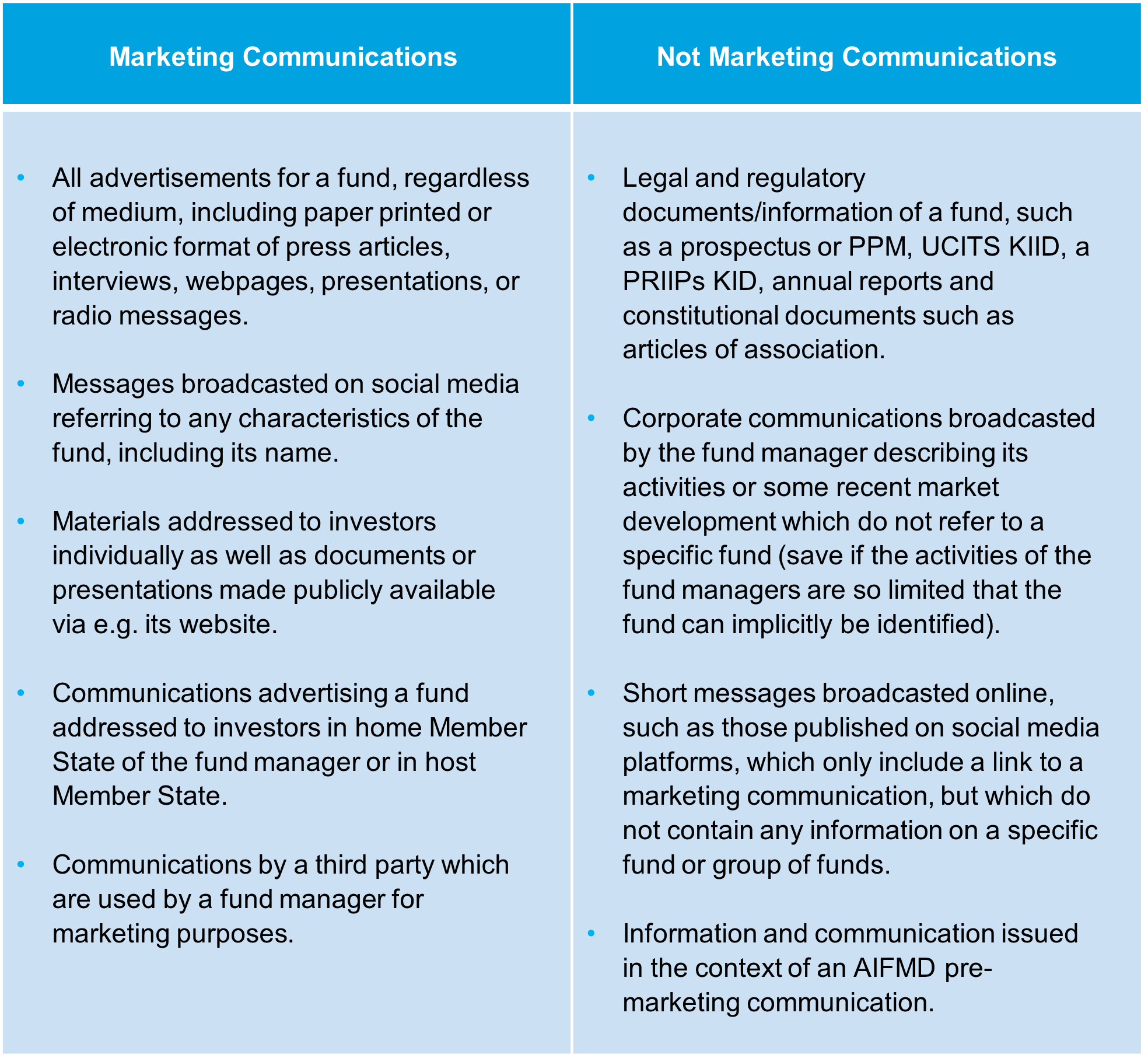

No definition of ‘marketing communication’ can be found in the CBDF Regulation or in the ESMA Guidelines. However, the ESMA Guidelines classify a non-exhaustive list of type of communications as marketing communications (or not):

Requirements that funds’ marketing communications must meet

If a communication qualifies as a ‘marketing communications’ in the meaning of the CBDF Regulation or the ESMA Guidelines, such communications must comply with strict legal requirements.

If applicable, any reference to a UCITS or an AIF in a press article, advertisement or press release on the internet or on any other medium may only be published after the home national competent authority (‘NCA’) of the promoted fund has granted approval.

For a first overview of the national rules applicable to the marketing of funds, check out the ESMA overview.

Marketing communications must be clearly labelled as marketing documents and inform (potential) investors that the communication is not a contractually binding document, or an information document required by law. This requirement will be deemed complied with when the marketing communication i) mentions clearly the terms “marketing communication” (preceded by the “#-symbol for social media use) and ii) includes a disclaimer such as the following:

“This is a marketing communication. Please refer to the [prospectus of the [UCITS/ AIF/EuSEF/EuVECA]/Information document of the [AIF/EuSEF/EuVECA] and to the [KIID/KID] (delete as applicable)] before making any final investment decisions.” For on-line marketing communication, a shorter identification of the marketing purpose of the communication is acceptable (e.g. the mere use of the terms “Marketing Communication” in the case of a banner or short videos or the “#MarketingCommunication” hashtag for social media platforms).

When a marketing communication includes information on potential benefit of purchasing units or shares of a fund (rewards), risk disclosure should be included also using the same font size in the body of the text and not in a footnote or in small characters. Both risks and rewards should be mentioned either at the same level or one immediately after the other.

The ESMA Guidelines also mention that the disclosure of the risk profile of the promoted fund in a marketing communication should refer to the same risk classification as that included in the KID or KIID.

In relation with the AIFs open to retail investors, if applicable, the marketing communication should clearly mention the illiquid nature of the investment.

All marketing communications should contain fair, clear and not misleading information. The level of information presented, and the wording used should be adapted to whether investment in the promoted fund is open to retail investors or professional investors. Moreover, the marketing communication should be written in the official languages, or in one of the official languages, used in the part of the Member State where the fund is distributed, or in another language accepted by the NCA of that Member State.

The information presented in the marketing communication must be consistent with the legal and regulatory documents of the promoted fund such as the prospectus, the offering memorandum (or PPM), the KID or KIID, annual reports,.

When a marketing communication describes some features of the promoted investment, such description should be up to date, accurate and proportionate to the size and format of the communication. The marketing communication should include at least a short description of the investment policy of the fund and an explanation on the types of assets into which the fund may invest.

The information contained in marketing communication should be presented in a way that is likely to be understood by the average member of the group of investors to whom it is directed or by whom it is likely to be received.

All statements embedded in the marketing communication should be adequately justified based on objective and verifiable sources, which should be quoted.

When referring to the costs associated with purchasing, holding, converting or selling units or shares of an AIF/UCITS, marketing communications should include an explanation to allow investors to understand the overall impact of costs on the amount of their investment and on the expected returns.

Where the currency applicable to the costs is different from that of the targeted investors’ residency, the marketing communications should clearly include the currency in question, as well as a warning that the costs may increase or decrease as a result of currency and exchange rate fluctuations.

In addition to the required up-to-date information on features of the investment (item 6 above), in a marketing communication information on past performance of the promoted fund should be consistent with the past performance included in the prospectus, the offering memorandum (or PPM), the KID or KIID or other regulatory provision.

The past performance is to be disclosed for the preceding 10 year for funds establishing a KIID, or for the preceding five years for other funds, or for the whole period for which the relevant funds have been offered, if less than five years. Past performance information should always be based on complete 12-months periods, but this information may be supplemented with performance for the current year updates at the end of the most recent quarter.

When the information on past performance is included, this information should be preceded by the following statement: “Past performance does not predict future returns”.

Information on expected future performance should be based on reasonable assumptions supported by objective data. It should be disclosed only prefund and on a time horizon consistent with the recommended investment horizon of the fund.

If the information on expected future performance is based on past performance and/or current conditions, this information should be preceded by the following disclaimer: “The scenarios presented are an estimate of future performance based on evidence from the past on how the value of this investment varies, and/or current market conditions and are not an exact indicator. What you will get will vary depending on how the market performs and how long you keep the investment/product.”

Marketing communications should also include at least a disclaimer according to which future performance is subject to taxation which depends on the personal situation of each investor and which may change in the future.

When a marketing communication refers to the sustainability-related aspects of the investment in the promoted fund, it should be consistent with the information included in the legal and regulatory documents of the promoted fund such as the website, periodic reports and relevant pre-contractual documentations as required following the Sustainable Finance Disclosure Directive and Taxonomy Regulation.

In particular, the information should not outweigh the extent to which the investment strategy of the product integrates sustainability-related characteristics or objectives.

For more general information on sustainability related information to include in a fund’s documentation, please read our other articles on the mandatory ESG-disclosure resulting from the Sustainable Finance Disclosure Regulation or the Taxonomy Regulation.