Below we outline some of the main items of this further Administrative Guidance (July 2023 AG), which is the second set of additional administrative guidance after the one of February 2023 (Feb 2023 AG).

For more information on the documents made available by the OECD on 17 July 2023 regarding the Subject-to-Tax Rule (STTR) or the GloBE Information Return (GIR), reference is made to our webiste articles here and here.

General Currency Conversion Rules

The financial accounts used to prepare the Consolidated Financial Statements of the Ultimate Parent Entity of an MNE are in principle the starting point for all GloBE calculations of an in-scope MNE. However, so far, neither the GloBE Rules nor the Commentary and Feb 2023 AG provided specific guidance in relation to which currency the relevant GloBE calculations should be made in, including for disclosure purposes in the GIR.

The July 2023 AG now clarifies this question as well as several other currency conversion related issues:

MNE Groups shall perform their GloBE calculations for each relevant jurisdiction in the presentation currency of the Consolidated Financial Statements to ensure consistency across the concerned jurisdictions. Where certain items relevant for the GloBE calculations have not already been translated into the presentation currency in the Consolidated Financial Statements on an item-by-item basis, MNE Groups will be required to translate such items in accordance with the applicable foreign currency translation rules of the Authorised Financial Accounting Standard based on which the Financial Accounting Net Income or Loss of Constituent Entities (CEs) in the respective jurisdiction is established. Special rules apply to the QDMTT calculation as outlined further below.

The amount of Top-up Tax allocable to a CE has to be determined in accordance with the GloBE Rules in the MNE Group's presentation currency. Thereafter, jurisdictions are free to apply their own foreign currency translation rules to convert the Top-up Tax liability due in their jurisdiction into local currency, as long as the exchange rate used is reasonable (the July 2023 AG notably proposes using (i) the average foreign exchange rate for the fiscal year to which the top-up tax relates, (ii) the year-end foreign exchange rate for the fiscal year to which the top-up tax relates, or (iii) the foreign exchange rate on the date the top-up tax is payable).

Finally, the July 2023 AG also updates and further clarifies foreign currency translation rules for determining whether a GloBE threshold expressed in a currency other than the presentation currency has been met. In order to avoid mismatches where, e.g., one jurisdiction would consider a threshold to be exceeded due to the application of an exchange rate different from the one applied in another jurisdiction, the applicable exchange rates are harmonised. However, the guidance is limited to determining whether a relevant threshold has been exceeded. To the extent that the relevant threshold is exceeded, any GloBE adjustment is to be based on the amount translated in accordance with the above-mentioned principles.

Guidance on Tax Credits

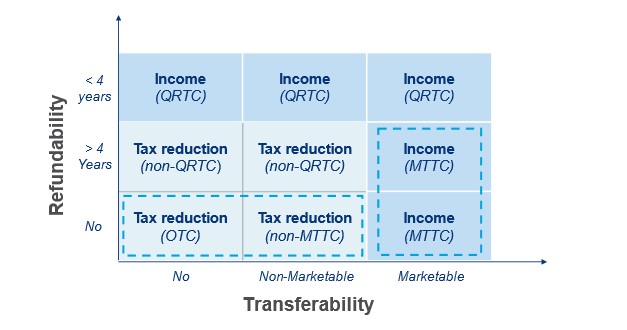

Under the GloBE Rules, there was already a key difference in the treatment of certain tax credits and government grants. A distinction is made between Qualified Refundable Tax Credits (QRTCs), which are refundable in cash or cash equivalents within four years, and Non-Qualified Refundable Tax Credits (Non-QRTCs), which are refundable after four years. A QRTC is treated as an increase to the GloBE Income (denominator), while a Non-QRTC is treated as a reduction to the Covered Taxes (numerator). Both therefore reduce the effective tax rate (ETR), but this effect is (in principle) much stronger for a Non-QRTC.

As there was still unclarity on the treatment of other kinds of tax credits, especially for tax credits that can be transferred, the July 2023 AG establishes the GloBE treatment of new categories of tax credits: Marketable Transferable Tax Credits (MTTCs), Non-Marketable Transferable Tax Credits (non-MTTCs) and Other Tax Credits (OTCs), regardless of how such tax credits are treated for financial accounting purposes. This comes in addition to the current distinction between QRTCs and Non-QRTCs. All refundable tax credits remain to qualify as QRTCs. MTTCs will be treated the same as QRTCs, i.e., an increase in GloBE Income instead of a decrease in Adjusted Covered Taxes. Non-MTTCs and OTCs reduce the amount of Adjusted Covered Taxes.

The July 2023 AG also contains further guidance on the Qualified Flow-Through Tax Benefits (QFTBs) that were introduced in the Feb 2023 AG.

These newly introduced concepts can be summarized as follows:

- MTTCs: a tax credit that can be used by the holder of the credit to reduce its tax liability and that meets the following cumulative standards:

- Legal transferability: this condition is met for the entity that engages in the activities that generates the tax credit (Originator) if the tax credit can be transferred to an unrelated party in the fiscal year that the entity is eligible for the credit or within 15 months after the end of that year. For the purchaser of a tax credit, this condition is met if it can transfer the credit to an unrelated party in the year in which it purchased the credit.

- Marketability: For the Originator, this condition is met if the tax credit is transferred to an unrelated party within 15 months after the year the entity is eligible for the credit (or, if not transferred or if transferred between related parties, similar tax credits are traded between unrelated parties within this period) for a price that equals or exceeds 80% of the net present value of the tax credit. For the purchaser of such a tax credit, this condition is met if it purchased the tax credit for such a price. Specific guidance is given on how to calculate this value. - Non-MTTCs: a tax credit that, if held by the Originator, is considered transferable but not considered a MTTC and, if held by the purchaser, is not a MTTC.

- OTCs: non-refundable and non-transferable tax credits that can only be used to offset a tax liability of the Originator.

In order to determine the category of a tax credit for GloBE purposes, it should first be tested whether it is refundable and qualifies as a QRTC. If it meets those criteria, it will be classified as a QRTC regardless of whether the conditions of a MTTC are met. If a tax credit is not considered a QRTC, it should be tested whether the transferability criterion is met and the tax credit can be considered a MTTC.

The introduction of the concept of MTTC is a welcome addition for MNE Groups that regularly make use of transferable tax credits, as the treatment as GloBE Income rather than reduction in Adjusted Covered Taxes is generally preferable for GloBE purposes (since imputing additional GloBE Income has less impact on the GloBE ETR than reducing the covered taxes for the same amount). The MTTC treatment is especially relevant for US-MNEs as many of the transferable credits arising under the Inflation Reduction Act are likely to benefit from this addition in the July 2023 AG.

Substance-based Income Exclusion

The July 2023 AG provides guidance on determining the Substance-based Income Exclusion (SBIE) with respect to Eligible Employees and Eligible Tangible Assets that are deployed outside the jurisdiction of the employer or owner CE, respectively.

The Inclusive Framework acknowledges that there are a variety of circumstances where an Eligible Employee would perform work activities outside the jurisdiction of their employer or where Eligible Tangible Assets would be located outside of the jurisdiction of their owner. For practicability purposes, the OECD/IF considers a threshold test above which the full payroll carve-out or tangible asset carve-out can be admitted appropriate.

Specifically, a full payroll carve-out or tangible asset carve-out can be claimed by the CE where:

- an Eligible Employee is located within the jurisdiction of its employer more than 50% of their working time; and

- an Eligible Tangible Asset is located within the jurisdiction of its owner more than 50% of the time.

If an Eligible Employee or Eligible Tangible Asset works or is located in the jurisdiction 50% or less of the time, the CE is only entitled to claim a pro rata share of the payroll carve-out and tangible asset carve-out for that Eligible Employee or Eligible Tangible Asset. The July 2023 AG announces that a simplified allocation mechanism with respect to industries with a substantial portion of their employees and assets located outside of the CE’s jurisdiction for a substantial part of the Fiscal Year is being considered as a next step.

Furthermore, the July 2023 AG clarifies that an MNE can also choose to only claim those Eligible Payroll Costs and Eligible Tangible Assets for which it was willing to undertake the relevant compliance work.

The July 2023 AG also provides further guidance on the following topics related to the SBIE:

The calculation of the stock-based compensation expenses to be taken into account under the definition of Eligible Payroll Costs;

- The calculation of the stock-based compensation expenses to be taken into account under the definition of Eligible Payroll Costs;

- the treatment of leased tangible assets at the level of lessor and lessee;

- how impairment losses and reversals on tangible assets shall be taken into consideration.

Qualified Domestic Minimum Top-up Tax

The July 2023 AG contains further specific guidance to the design and operation of a QDMTT. This follows the Feb 2023 AG in which the two guiding principles for implementing a QDMTT were set out. Below we focus on a number of specific topics set out in the July 2023 AG:

- The Feb 2023 AG mentions that the imposition of a QDMTT can result in a greater tax charge than the tax charge that would otherwise have been imposed on the GloBE Rules (e.g., in situations in which the MNE Group holds less than a 100% Ownership Interest in the CE).

- The July 2023 AG clarifies that this also applies to Joint Ventures, JV Subsidiaries and MOCEs. It requires the Top-up Tax due to be allocated to (a member of) the Joint Ventures, JV Subsidiary or MOCE itself. This deviates from the ‘regular’ QDMTT rules under which the rules to allocate the QDMTT liability is left to the implementing jurisdictions.

- The possibility for jurisdictions to design their QDMTT legislation to apply only where all domestic CEs in the jurisdiction are 100% owned by the UPE or a partially-owned parent entity (POPE) for the entire Fiscal Year remains open.

If a QDMTT is imposed on a sub-national governmental level based on domestic law this may result in jurisdictional blending limited to the CEs located in such sub-national jurisdiction. According to the July 2023 AG, this in itself should not prevent the tax to qualify as a QDMTT. The same holds if the QDMTT is applied on the basis of a taxable unit (e.g., CE-by-CE blending if the taxable unit is treated as a single CE).

- Neither the Feb 2023 AG nor July 2023 AG requires a certain allocation of QDMTT between CEs in order for the QDMTT to be considered functionally equivalent to the GloBE Rules (with the exception of the abovementioned allocation rules regarding Joint Ventures, JV Subsidiaries and MOCEs), as long as the QDMTT is enforceable against at least one CE in that jurisdiction.

- The July 2023 AG, however, does provide illustrative examples to support jurisdictions in the design of their QDMTT.

- The July 2023 AG clarifies that – similar to guidance previously provided for CFCs – taxes paid by CE-owners on the income of Hybrid Entities should in principle be disregarded in calculating the ETR for QDMTT purposes.

- However, this does not apply to any withholding taxes on dividends distributed by a CE to its owner. Such taxes are considered in the calculation of the ETR in the jurisdiction of the distributing CE for QDMTT purposes (therefore reducing the QDMTT due).

- The July 2023 AG clarifies that – similar to guidance previously provided for CFCs – taxes paid by CE-owners on the income of Hybrid Entities should in principle be disregarded in calculating the ETR for QDMTT purposes.

- However, this does not apply to any withholding taxes on dividends distributed by a CE to its owner. Such taxes are considered in the calculation of the ETR in the jurisdiction of the distributing CE for QDMTT purposes (therefore reducing the QDMTT due).

- The Transition Year may be different for GloBE Rules than for QDMTT purposes (e.g., because the GloBE Rules entered into effect in a year after the QDMTT already entered into effect). As a result of the Transition Rules, this could result in tax attributes for the same CE being different for GloBE and QDMTT purposes.

- The July 2023 AG introduces the notion of a “refresher” of the Transition Year for purposes of Article 9.1.1. and 9.1.2. of the model GloBE Rules when the GloBE Rules come into effect after the QDMTT is entered into effect. As a result of this refresher, there may be an impact on certain tax attributes that arose under the QDMTT. This includes the deferred tax liabilities subject to the recapture rules, a deferred tax asset under the GloBE Loss Election and Excess Negative Tax Expense Carry-forwards.

- As already mentioned in the December 2022 Safe Harbours and Penalty Relief publication of the OECD / IF, for purposes of Article 9.1.3 of the model GloBE Rules, the Transition Year is the one of the disposing CE, i.e., the first year in which the Low-Taxed Income of that CE becomes subject to a charge under the GloBE Rules or becomes subject to a QDMTT. This is irrespective of when other CEs in the jurisdiction are subject to the GloBE Rules. The Transition Year for Article 9.1.3. is therefore not dependent on the Transition Year for the acquiring CE.

- Where the QDMTT is based on the Consolidated Financial Statements of the UPE, the QDMTT computations should be done in the presentation currency of such statements.

- Where QDMTT is based on local accounting standards and all CEs use this local currency as their functional currency, the QDMTT should be computed in such local currency.

- Where a QDMTT is based on local accounting standards where not all CEs have the same functional currency, the QDMTT computation must be made in one single currency.

- The currency translation rules of the local accounting standards have to be used for purposes of the QDMTT computations.

- A Five-Year Election may be made for all CEs to either undertake the QDMTT computations: (a) in the presentation currency of the Consolidated Financial statements or (b) in the local currency.

- The amount of QDMTT accrued (if any) shall not be treated as payable for purposes of calculating any Top-up Tax due, to the extent challenged by the taxpayer based on legal grounds outside the QDMTT or GloBE Rules, such as a constitutional challenge or a specific agreement with the government of the QDMTT jurisdiction. The July 2023 AG however does not appear to outline what happens if subsequently the challenge is denied and QDMTT is nevertheless payable.

- To the extent the QDMTT is not payable based on the reasons described above, the QDMTT Safe Harbour discussed below will not apply. Instead, the credit mechanism for the QDMTT should be applied.

- If a QDMTT jurisdiction is of the view that it cannot impose QDMTT to certain taxpayers based on constitutional restrictions or tax stabilisation agreements, it should notify this in the peer review process.

- The July 2023 AG also notes that there are other circumstances in which QDMTT may not be considered payable and indicates that further Administrative Guidance will follow.

Safe Harbours

The July 2023 AG contains further guidance on the design of a permanent QDMTT Safe Harbour and introduces a temporary Transitional UTPR Safe Harbour.

QDMTT Safe Harbour

Under the GloBE Rules, a QDMTT is creditable for the application of the IIR and UTPR. However, this means that at least two Top-up Tax calculations are required for the same jurisdiction (i.e., in the IIR/ UTPR jurisdiction and in the QDMTT jurisdiction). The QDMTT Safe Harbour intends to provide a practical solution for this issue. Under the QDMTT Safe Harbour, the Top-up Tax payable is deemed to be zero for a jurisdiction applying the IIR or UTPR with respect to another jurisdiction, if a QDMTT is levied by this other jurisdiction and certain conditions are met. It is important that the QDMTT is actually paid.

In order for a QDMTT to qualify for this permanent safe harbour, the QDMTT should meet the following three standards:

The QDMTT legislation should adopt one of the following rules:

- The GloBE calculations should be based on the UPE’s financial accounting standard, in line with the same provisions in the GloBE Model Rules; or

- The GloBE calculations should be based on Local Financial Accounting Standards, provided various requirements are met and adjustments are made if necessary.

The QDMTT computations should be the same as the computations under the GloBE Rules except for the deviations required under the QDMTT commentary (see above). The Consistency Standard is also met if the QDMTT:

- does not include or has a more limited SBIE;

- does not include or has a more limited De Minimis Exclusion;

- applies a minimum tax rate above 15% to determine the Top-up Tax Percentage.

The QDMTT jurisdiction should meet the requirements of the peer review process in which the Inclusive Framework jurisdictions review each jurisdiction’s QDMTT legislation. The peer review process is still to be developed.

Transitional UTPR Safe Harbour

The UTPR is designed to operate as backstop to the GloBE Rules to encourage jurisdictions to introduce a QDMTT or IIR. The OECD recognizes that it would become the primary mechanism to levy Top-up Tax from a UPE jurisdiction that has not introduced a QDMTT. The Inclusive Framework acknowledges that this is undesirable because (i) the Top-up Tax allocated under the UTPR related to a UPE jurisdiction will often be disproportionate to the profits in the UTPR jurisdictions and (ii) there are more possibilities for disputes to arise under the UTPR.

The July 2023 AG therefore introduces the Transitional UTPR Safe Harbour which aims at providing relief for years commencing on or before the end of 2025 and ending before 31 December 2026. This means that for taxpayers for which the financial year corresponds to the calendar year, the Transitional UTPR Safe Harbour can be applied to FY 2025 at the latest.

Under the Transitional UTPR Safe Harbour, the Top-up Tax for the UPE jurisdiction would be deemed to be zero provided that the UPE jurisdiction has a nominal corporate income tax rate of 20%.

It will be interesting to monitor how the EU / EU Member States will implement this Transitional UTPR Safe Harbour rule, since there are EU Member States that have a nominal corporate income tax rate of less than 20%.

The Transitional UTPR Safe Harbour will notably provide welcome relief for the domestic operations of US based MNEs, given the fact that the US currently does not plan to introduce a QDMTT and has a nominal corporate income tax rate of at least 20%. It is also a welcome relief for jurisdictions that will implement the GloBE Rules but only do so after 31 December 2024.

What’s next?

The July 2023 clarifies various practical implementation questions, in particular also regarding the long-awaited details for the design of local QDMTT legislation and QDMTT Safe Harbour. It also provides some transitional relief, in particular introducing the temporary UTPR Safe Harbour which may be welcomed in particular by US MNEs. At the same time, the Inclusive Framework acknowledges that further clarification work will need to be done in the upcoming months. We will keep close track of these developments and provide respective updates.

In parallel to the additional adminstrative guidance, the OECD also released an updated GIR (see our website article) and a model treaty provision for the Subject-to-Tax Rule (see our website article).

We will keep you informed of further developments. In case of any question, please contact an author of this tax newsletter or your trusted Loyens & Loeff adviser.