The government has set the wage norm at 0%. This basically means that wages in 2023-2024 cannot in principle be increased compared to 2021-2022.

However, the wage norm law provides that indexations or pay scale increases are always guaranteed and thus excluded from the calculation of the wage norm. Also, certain other wage elements such as non-recurring bonuses, profit premiums or innovation premiums are not taken into account when calculating the wage standard.

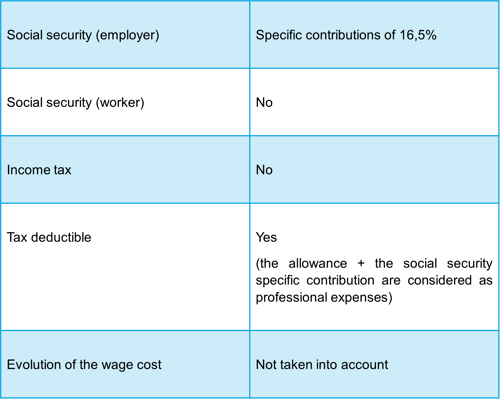

Finally, employers also have the option of granting their employees a one-off net purchasing power allowance. The conditions for granting this purchasing power allowance differ depending on the type of agreement entered into:

- If the purchasing power allowance is granted in a sectoral CBA, it will be a maximum of 500 euros for companies that have made high profits in 2022, while it will be a maximum of 750 euros for companies that have made exceptionally high profits in 2022. To be valid, this CBA must include the definitions of "high profits in 2022" and "exceptionally high profits in 2022".

- If the purchasing power allowance is granted in a CBA concluded at company level, these notions do not apply and only a justification of "good results" "during the crisis" is required. In other words, a justification that it is a company that has achieved good results during the crisis must be added.

- If the purchasing power allowance is granted by individual agreement, where no CBA can be concluded due to the absence of a trade union delegation or if it concerns "a category of personnel for which it is not customary to provide for such an agreement", there are no additional conditions concerning "high profits" or "results".

The purchasing power allowance can only be granted up to and including the 31st of December 2023 and will be valid up to and including the 31st of December 2024.