To answer this question, we will comment the differences between a long-term lease (as regulated in the new Book 3) and a (retail) lease from various perspectives.

Download the presentation here. You will also find below an infographic explaining the changes to the long-term lease right as well as the recordings in French and Dutch of our webinar on the subject.

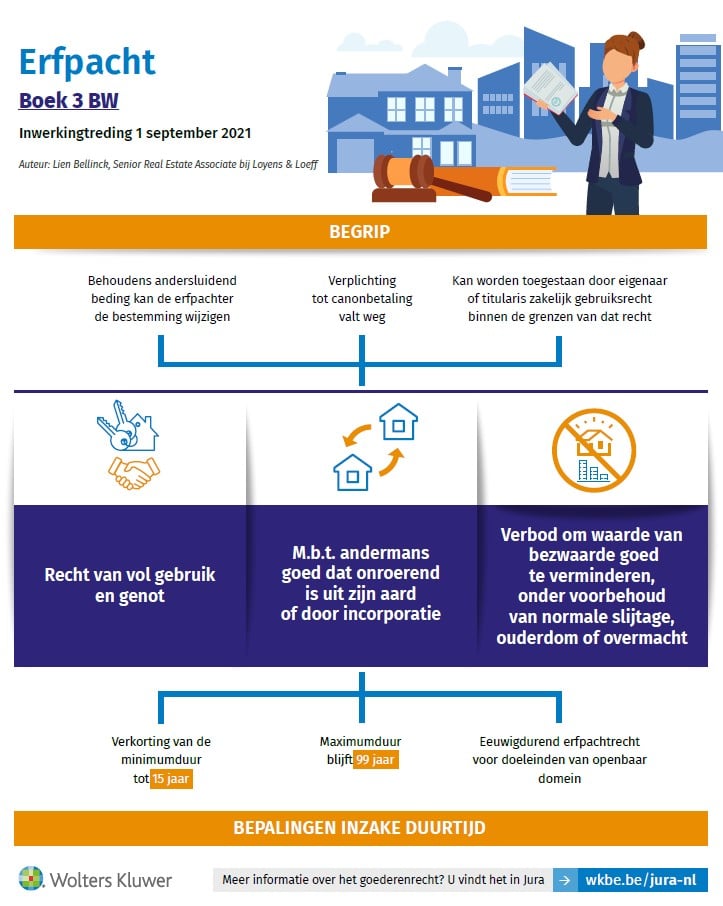

The mandatory minimum duration of long-term lease rights will be 15 years. The maximum duration remains unchanged: long-term lease rights can be granted for maximum 99 years. The new Book 3 provides one exception: if and to the extend that the long-term lease right is granted for public domain purposes, a perpetual long-term lease right can be established.

Regarding the early termination, the new Book 3 provides that it is not possible to unilaterally terminate the long-term lease during the minimum duration of 15 years, but only afterwards. In addition, if the long-term lessee relinquishes his long-term lease right, this will only have consequences for the future. If the long-term lease right was granted against payment of a certain fee (i.e. a canon), the long-term lessee will not be able to free himself from his obligation to pay that canon: in the event of a renunciation, the long-term lessee will remain liable for the payment of the current and future canons. On the other hand, the new Book 3 confirms that it is possible to terminate the long-term lease right by amicable agreement of both parties at any time. In that case, however, the termination will only have relative effect: the termination will not prejudice the rights of bona fide third parties (e.g. the financier of the long-term lessee) on the terminated long-term lease right.

Finally, the new Book 3 confirms that a long-term lease right can be renewed provided that the parties explicitly agree with such renewal and the maximum duration of 99 years is being complied with.

Retail leases are subject to a much more restrictive regime: retail leases must be concluded for at least 9 years, the tenant being entitled by law to request 3 renewals of 9 years each (subject to compliance with specific formalities). Nevertheless, the tenant’s right to request a renewal of the retail lease is not absolute. To protect landlords, the Commercial Lease Act provides that a renewal can always be refused by the landlord. If the landlord refuses the renewal without any reason, he must pay a mandatory compensation to the tenant, amounting to 3-year rent. If the renewal is justified by certain limited circumstances, the compensation may be lower.

Contrary to the rules on long-term leases, the Commercial Lease Act provides that a retail tenant is entitled to early terminate the retail lease at the end of each 3-year period. No indemnification or justification is required. If explicitly stipulated in the retail lease agreement, the landlord may also terminate the retail lease at the end of each 3-year period provided that he or a close relative intends to run a business in the leased premises. In such case, the tenant can claim an eviction indemnity of which the amount depends on the nature of the new business. Finally, a retail lease can also be terminated by mutual consent, but in such case, the mutual agreement must be formalised.

Looking at the duration, it can be said that the conclusion of a long-term lease right shall guarantee to both parties an occupation of 15 years.

Consideration

A major difference between long-term lease rights and leases is the consideration although it seems theoretical in commercial real estate. The canon is not an essential elements of a long-term lease right, while the rent is for a lease. In both, the parties can freely determine the amount of the initial consideration.

When it comes to indexation and revision, there exists no legal provision for long-term lease rights; it is left to the contractual freedom of the parties. It is totally different for leases. In case the parties agree to yearly adapt the rent to the cost of living, the indexation formula provided by law is compulsory. For retail leases, each party can, during a period of 3 months prior to the end of every 3-year period of the lease, file a request to review the rent with the Justice of the Peace provided the rent value of the leased premises has changed by at least 15% due to new circumstances.

Looking at the consideration, it can be said that the conclusion of a long-term lease right shall guarantee to both parties the consideration throughout its duration. The long-term lease right offers also more flexibility when it comes to indexation and revision of the price.

1.During the term

Transfer and mortgage. The long-term lessee may transfer his long-term lease right and encumber it with a mortgage (see our last article on this matter). In case of transfer, he will not be released from this obligation to pay the canon (and will remain jointly liable with the transferee), but will well be released from the other obligations as from the transfer (e.g. the maintenance and repairs obligations). In case of a lease, the tenant cannot mortgage his tenancy right or the constructions of which he is the temporary owner based on his accessory building right. Based on the general lease principles, a tenant can transfer his tenancy right, unless the parties agreed otherwise. The Commercial Lease Act provides specific rules in case the transfer of the tenancy right takes place together with the transfer of the business. In case of transfer of the tenancy right, the tenant remains jointly and severally liable with the transferee for the performance of the obligations due after the transfer, such as the payment of the rent.

Right on the premises. The long-term lessee has the right to use and enjoy the immovable property to which his long-term lease right relates. Unless otherwise agreed, he can build constructions on the encumbered property, of which he will be the temporary owner based on his accessory building right. The only thing the long-term lessee is not allowed to do is to reduce the value of the encumbered property (subject to normal wear and tear, age and force majeure). The long-term lessee may change the destination of the property to which his long-term lease right relates, unless otherwise agreed in the long-term lease agreement. With a lease, tenants have the right to use and enjoy the leased premises in accordance with their destination as contractually agreed (or derived from the facts and circumstances in the absence of any contractual provision). Landlords must allow their tenant to peacefully enjoy the leased premises during the lease and, amongst others, safeguard them in case of defects in the leased premises that prevent their use. Regarding alterations, the general lease principles provide that, unless otherwise agreed, tenants are only allowed to alter the leased premises if the alterations can be removed at the end of the lease without damaging the leased premises. With regard to retail leases, the Commercial Lease Act provides in addition that a retail tenant is allowed to perform any useful and important renovation works required to adjust the leased premises to his business needs if (i) the renovation works do not permanently alter the structure of the leased premises, (ii) the total cost of the works does not exceed 3-year rent, and (iii) the works do not affect the safety of the leased premises, their aesthetic value or their health aspects. Prior to the carrying out of such useful and important renovation works, the tenant must request approval of the landlord by way of a formal procedure. If the landlord does not agree with the suggested alterations, the tenant may submit the matter to the Justice of the Peace.

Maintenance and repairs obligations. In a long-term lease right, the long-term lessee must carry out all maintenance repairs and major repairs within the meaning of articles 3.153 and 3.154 of the Civil Code on the property to which his long-term lease right relates and on the constructions he is required to erect, so as not to reduce their value. In a lease, and unless the parties have agreed otherwise, tenants are only liable for minor repairs and “small” maintenance works to be carried out during the lease, with the exception of repairs resulting from normal wear and tear or force majeure. The landlord remains liable for all the remaining repairs and maintenance works, including major repairs, such as roof or structural repairs

Taxes and charges. During the long-term lease right, the long-term lessee is liable for all charges and taxes relating to the property to which his long-term lease right relates and relating to the constructions owned by him based on his accessory building right. There is no specific legal provision in this respect for a lease (except for residential leases).

2. At the end

At the end of the long-term lease right or of the lease, accession will take place. Consequently, the ownership over the constructions or alterations built or installed during the term of the right shall revert to the owner. In case of a long-term lease, the owner must compensate the long-term lessee for the constructions that he acquires at the end of the long-term lease, on the grounds of unjust enrichment. Until the payment of this compensation, the long-term lessee has a lien on the constructions. No similar legal provision exists for leases.

Looking at the rights and obligations of the parties, major differences exist between a long-term lease and a lease. It should however be noted that the legal provisions in this respect are subsidiary and that the parties can contractually agree otherwise.

For the comparison being relevant the working assumption is that we are speaking about a “new building” for which it must be opted to subject the long-term lease right or the lease to VAT, and that the parties shall opt. We also consider a 15-year duration.

The granting of a long-term lease right on such building can be subject to VAT at a rate of 21%. In case of a lease, the parties shall also opt to subject the lease to VAT at a rate of 21%. But from a VAT standpoint, the qualification of both transactions shall differ:

- The granting of a long-term lease right qualifies as a delivery of good (livraison de biens / levering van goederen). Consequently, (i) the VAT is calculated and due over the total consideration for the entire duration of the right and (ii) the VAT claw back (révision/herziening) risk over a period of 15 years is shifted to the long-term lessee since his right is an investment good in his hands. It also means that the long-term lessee must pay (and thus prefinance) the VAT upon inception. The grantor, provided that the total consideration represents at least 97.50% of his investment, will be able to recover the VAT paid on the construction cost.

- The (retail) lease qualifies as a supply of services (prestation de services / diensten). Consequently, the VAT shall be invoiced together with the rent (and charges) without any prefinancing for the tenant at inception of the lease. The landlord will have already deducted the VAT on the construction cost irrespective the duration of the lease or the rent level. However, in such a case, the property remains an investment good in the hands of the landlord who will bear the VAT claw back risk over a period of 25 years.

In case VAT would not be applicable (anymore) upon inception or renewal, transfer taxes apply at a rate of 0.2% for (retail) leases and 2% for long-term leases.

Looking at the VAT aspects, and assuming both transactions can be subject to VAT via an option mechanism, it could be concluded that the situation should be neutral. A major difference however exists, considering the VAT qualification of such transactions: in a long-term lease, the VAT claw back risk over a period of 15 years is shifted to the long-term lessee, while it stays with the owner, over a period of 25 years, in case of a (retail) lease.

A long-term lease is a property right while a (retail) lease is a personal right; only on this basis differences exist between both and they are important. These differences can be advantageous to one or the other party, or to both parties. It must also be said that when it comes to the rights and obligations of the parties, the contractual freedom largely prevails. In our view, the decisive criterion for choosing one or the other will be the (fixed) duration that the parties want to give to their agreement.