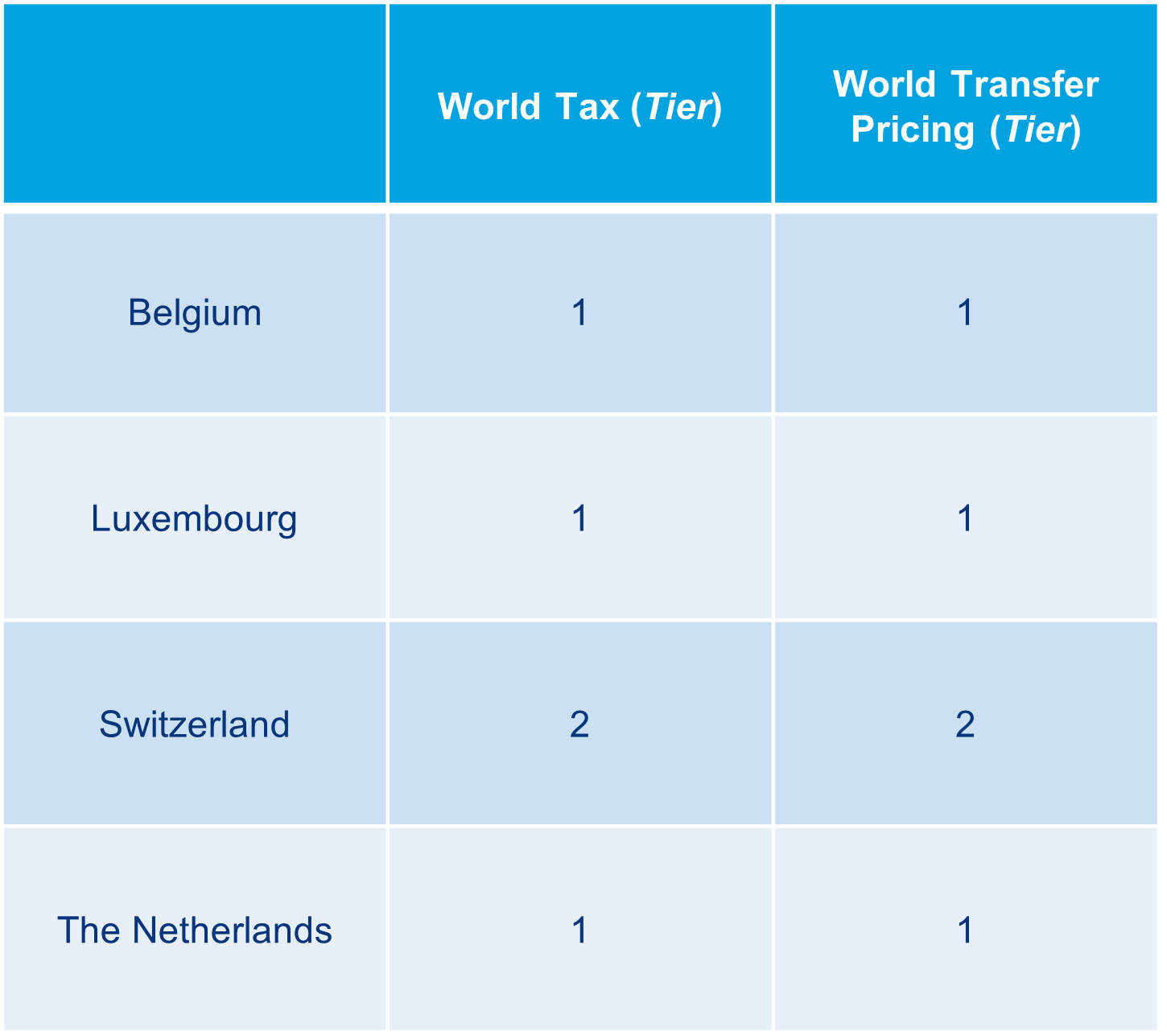

World Tax and World Transfer Pricing

- World Transfer Pricing: Belgium has gone from Tier-2 to Tier-1.

- World Transfer Pricing: Switzerland has gone from Tier-3 to Tier-2.

- World Tax: Switzerland has gone from Tier-3 to Tier-2.

The Tier-1 positions for World Tax and World Transfer Pricing are in:

- Belgium: Tier-1 in Tax, Tax Controversy and Transfer Pricing.

- Luxembourg: Tier-1 in General Corporate Tax, Tax Controversy and Transactional Tax and Transfer Pricing.

- The Netherlands: Tier-1 in General Corporate Tax, Tax Controversy, Indirect Tax, Transactional Tax and Transfer Pricing.

View all rankings on ITR World Tax.

In the table below, you will find an overview of our Tier-rankings in Belgium, Luxembourg, Switzerland and The Netherlands in the World Tax and World Transfer Pricing guides: