Conditions

The conditions that must be met, by both the expatriate employee and the employer, are as follows:

- The expatriate must be a non-Belgian national and citizen. This means that not only the expatriate has no Belgian nationality, he or she may not have been previously considered as a Belgian tax resident.

- The expatriate must be an executive or an employee with specialist skills that are difficult to find on the Belgian labor market.

- The expatriate must have been either directly recruited abroad by a Belgian company or temporarily assigned from abroad to a Belgian entity that is part of an international group of companies. To be “international”, the group must have a formal/fiscal presence in at least one country other than Belgium.

- The expatriate must maintain his/her center of personal and economic interests outside of Belgium. As evidence of this, the expatriate may point to several indicators. Although none of the criteria listed below, is, on its own, sufficient to prove the expatriate’s non-residency, when considered together, they will determine whether an applicant qualifies as a (fictitious) non-resident or not:

- spouse/partner and/or children reside in the home country;

- ownership of real estate in the home country;

- holding and managing personal investments in the home country (e.g., bank and saving accounts, credit cards, life assurance, etc.);

- participating in the home country’s (employer’s) pension plan;

- continuity of cover under the home country’s social security scheme;

- the possibility of being (re-)assigned to another group company outside of Belgium.

- The expatriate must be temporarily assigned to Belgium.

Application and duration

To be eligible for this special tax regime, the expatriate must file, jointly with his/her (Belgian) employer, an application to the Director of Foreign Taxes within 6 months following the month in which the expatriate started his/her assignment in Belgium. If this deadline is not met, the special tax regime can still be obtained, but will only take effect as of January 1 of the year following the filing of the application. It is still a requirement that the individual should not yet have been assessed as a Belgian tax resident.

You can read in this article what elements of the procedure change when submitting a request for the special tax regime for foreign expatriates. For example, a new information sheet must be annexed to the request as from 1 March 2021.

Employment Income

The special tax regime can be applied to employment income, paid or provided by the employer. Employment income includes salary, bonuses and other cash payments, as well as benefits in kind, such as a company car, stock options and housing allowance. However, “income from past employment”, such as severance payments and income paid during garden leave, are excluded.

Tax Benefits

Belgian (fictitious) non-resident tax status

The expatriate, benefiting from the special tax status, although living in Belgium with his family, will be deemed to be a non-resident for income tax purposes and will therefore only be taxed on his personal and professional Belgian source income.

Capped tax-free allowances

Tax free allowances are exempted from taxation as they qualify (for Belgian income tax purposes) as what is known as “employers’ own costs”. These tax free allowances are exempt from income tax up to a limit of either 11.250 EUR or 29.750 EUR per annum. The higher cap only applies if (1) the employer’s activity is exclusively that of coordination and control or the employer qualifies as a research and development center and (2) the employee performs an activity of the same nature.

The tax free allowances, subject to these caps, include:

- A cost of living allowance: for the difference in cost of living between Belgium and the home country;

- A housing allowance: for the difference in housing costs between Belgium and the home country;

- A tax equalization allowance: this relates to the difference in the tax burden between Belgium and the home country;

- A home leave allowance: for the expatriate to visit, once a year, his/her family in his/her home country (it amounts to the economy class return fare, reimbursed to the expatriate, for the family to visit the home country each year);

- Foreign exchange losses (exchange rate);

- Storage costs.

Most of the above non-taxable allowances are calculated according to the guidelines issued by the Belgian tax authorities (referred to as the “Technical Note”) unless a separate company policy is approved by the Belgian tax authorities.

Uncapped tax free allowances

In addition to these capped, tax free allowances, the Belgian tax authorities also allow deduction of a tax free reimbursement of (1) school fees and (2) inbound/outbound removal costs. The expatriate must be able to substantiate these costs with invoices. Regarding school fees, they must in principle relate to the expatriate’s children attending primary or secondary full time tuition in an international school.

Foreign travel exclusion

That part of the expatriate’s salary that corresponds to business days worked abroad, is exempted from taxes as well. This foreign travel exemption is usually calculated on the basis of the number of days worked outside Belgium. Other methods may apply (such as dual payroll) but are subject to prior approval by the authorities and are less frequent. Please note that special rules apply to determine what qualifies as foreign business days.

Exemption from Belgian social security contributions

Belgian social security contributions are not due on the tax free allowance (see above), increased with its equivalent foreign travel exclusion, however capped at 29.750 EUR per annum. School fees and inbound/outbound moving costs are also exempted from social security contributions, under the same conditions as apply for their income tax exemption.

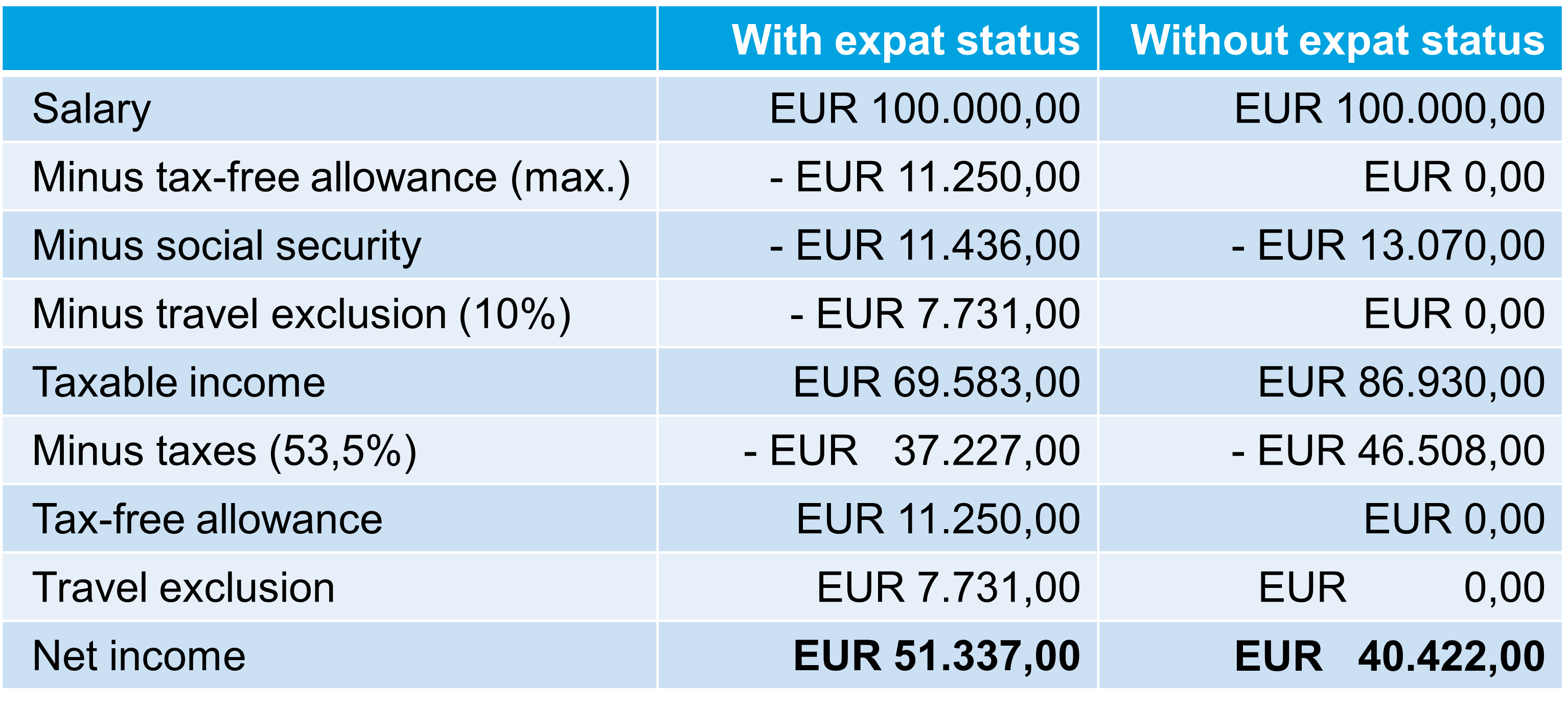

Example of how the special tax regime works out

The following is an example of how the special tax regime works out for an employee with an annual gross salary of 100.000 EUR. For simplicity, we have applied a 53,5% tax rate.